Expertise Supplies

Supplies just need to end up being affirmed and are not essential so you can end up being taken. Reserves are liquid funds that you may possibly gain access to in the event that you’d so you’re able to.

Supplies are usually mentioned from inside the weeks away from supplies with regards to having a computed level of weeks out of PITI (dominant, attract, fees, insurance) in savings, and you may designed for detachment.

FHA and you may Va typically cannot disqualify your from automatic underwriting program unless you provides supplies, but if you find it difficult getting an automated underwriting recognition, having reserves normally offset chance given that a good compensating basis.

- Examining or family savings

- Cash value of life insurance coverage (if the withdrawal was acceptance)

- 401k or other advancing years account (in the event that withdrawal is actually desired)

- Cash property value stocks, bonds, or other liquid assets

Supplies is difficult because they can will vary significantly from just one financing program to a different, and are generally a familiar overlay put in the brand new underwriting direction because of the a loan provider.

This is not strange to have a loan provider to adopt reserves due to the fact a good compensating component that get let them accept greater risk areas of the job, such as for example reasonable credit scores or large financial obligation in order to money ratios.

It’s very not uncommon to have a loan provider to simply demand set aside requirements in order to filter out funds that they perceive to get off higher risk out of coming default.

Using Present Fund?

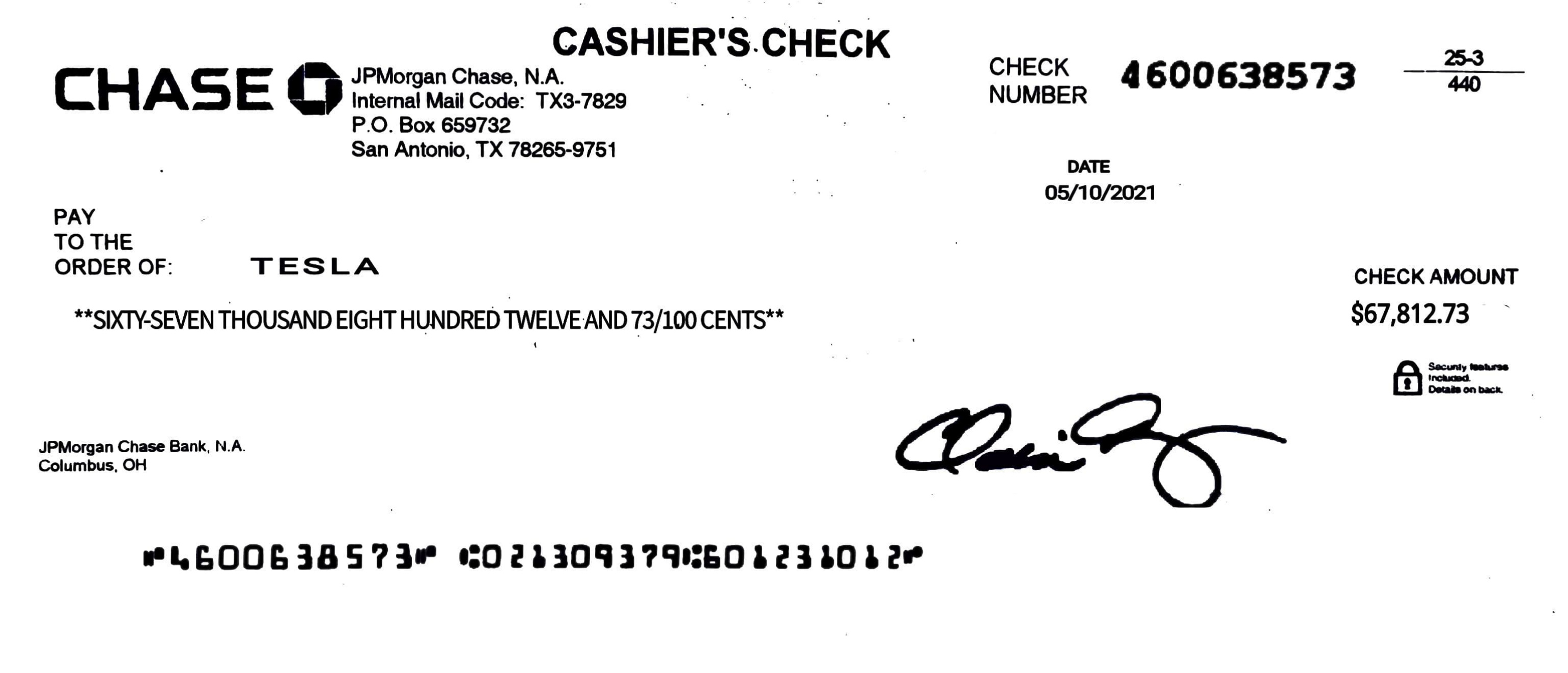

Very loan sizes enables you to fool around with present fund to own closure can cost you and/otherwise reserves. Provide fund normally always feel recognized by the a near nearest and dearest representative such as a moms and dad, dad, sibling, otherwise cousin.

How you can undertake provide finance is to try to feel the donor wire money straight to the fresh new closure table. Very underwriters have a tendency to request comments on the donor to verify that they had the cash available to gift.

The fresh new current-giver must sign a gift Page stating their relationship to your (the customer), the level of this new provide, in addition to comprehending that the cash are a present, that will be maybe not likely to be paid straight back.

Present fund is experienced exactly like this new closing rates and you will put aside documentation requirements, that’s normally statements within the most recent two months earlier to closing.

NOTE: Provide loans transferred into your membership before the latest a few months‘ membership comments are believed experienced loans and don’t should be acquired.

Faq’s

Generally, moving money from coupons toward checking, so you’re able to have the cash accessible to generate a to shut on your own domestic, is not considered difficulty. Your bank may decide to find a number of additional months from statements on the savings account to confirm the cause of the poor credit signature loans for anyone currency prior to the flow.

Exactly how many Bank Statements Will be required To have Home loan Approval?

Really lenders commonly demand 2 months off comments for every away from the bank, retirement, and investment accounts, although they may consult a whole lot more months whether they have concerns.

How come Loan providers You would like Bank Comments?

Among the many some thing a loan provider actively seeks in advance of approving a good mortgage is your full financial predicament and you will reserves. They’re seeking find out how far money you might offer to be able to help make your homeloan payment in case there are hard times like shedding your task, being unable to performs because of burns otherwise illness, an such like. without the need to offer assets. Reviewing all your valuable financial, advancing years, and you will financial support account statements enables them to observe how high off a reserve you’ve got easily accessible.

Also looking for sources of financing wanting to make certain that places in the accounts can be fairly said. Essentially, he could be checking to see if you have got obtained gift ideas away from money which make your finances look a lot better than they actually are in the long term.